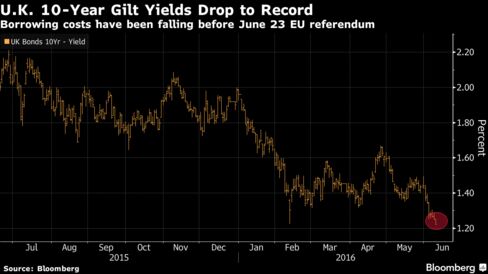

The U.K.’s 10-year government bond yield dropped to a record before the nation’s referendum on European Union membership.

Gilts rallied with Treasuries as investors seek havens as global economic optimism cools, and before Britain votes June 23 on whether to remain in the bloc. The Bank of England may ease policy if the nation decides to leave, according to Mohit Kumar, head of rates strategy at Credit Agricole SA’s corporate and investment bank unit. That’s supporting the U.K.’s sovereign debt, even as concern it may quit the EU has made the pound the worst-performing Group-of-10 currency this year.

“Gilts and government bonds are driven by risk aversion and position-squaring into the referendum,” said Kumar. “Investors would be wary to have much risk over the vote given the binary nature of the event. So, fixed income should rally. And if the U.K. does vote to leave, the Bank of England would go much more dovish, and that is bullish for the front end of the U.K. government-bond yield curve.”

U.K. 10-year gilt yields fell one basis point, or 0.01 percentage point, to 1.24 percent as of 11:38 a.m. London time. It earlier touched 1.220 percent, the lowest since Bloomberg started tracking the data in 1989. The 2 percent security due in September 2025 rose 0.095, or 95 pence per 1,000-pound ($1,445) face amount, to 106.595.

The yield on German 10-year bonds was little changed at 0.05 percent, after earlier dropping to match a record-low 0.033 percent reached on Wednesday. Treasury 10-year note yields fell two basis points to 1.69 percent.

The pound fell 0.4 percent to $1.4451. It’s down 1.9 percent against the U.S. currency this year.

Brexit Risk

“There is definitely Brexit risk in gilt valuations, and you could argue there is even a slight cut priced in” to the BOE’s key rate, Owen Murfin, a money manager at BlackRock Inc., said at a briefing in London. “The Bank of England isn’t expected to raise rates until 2018 despite having an underlying economy that is fairly robust.”

Murfin said the probability of Brexit “has been priced in to a certain amount in gilts so if there is a ‘Remain’ outcome you would have thought the initial outcome might be to price the Bank of England closer to the Federal Reserve.”

The yield difference between 10-year gilts and similar-maturity U.S. Treasuries was little changed at 44 basis points. U.S. yields were 48 basis points higher in March, the most since 2006.

The 10-year yield could fall further to 1 percent in the event of Brexit, according to Daniela Russell, a portfolio construction associate at Legal & General Group Plc in London. She said new lows may be seen in the coming months.

“The broad global macro backdrop has softened again,” Russell said. “So even if the market feels some relief after a vote to remain, we are going to have to wait several months for it to become clear whether the recent weakness in the U.K. data is just Brexit-uncertainty-related.”

Source: Bloomberg

No comments:

Post a Comment