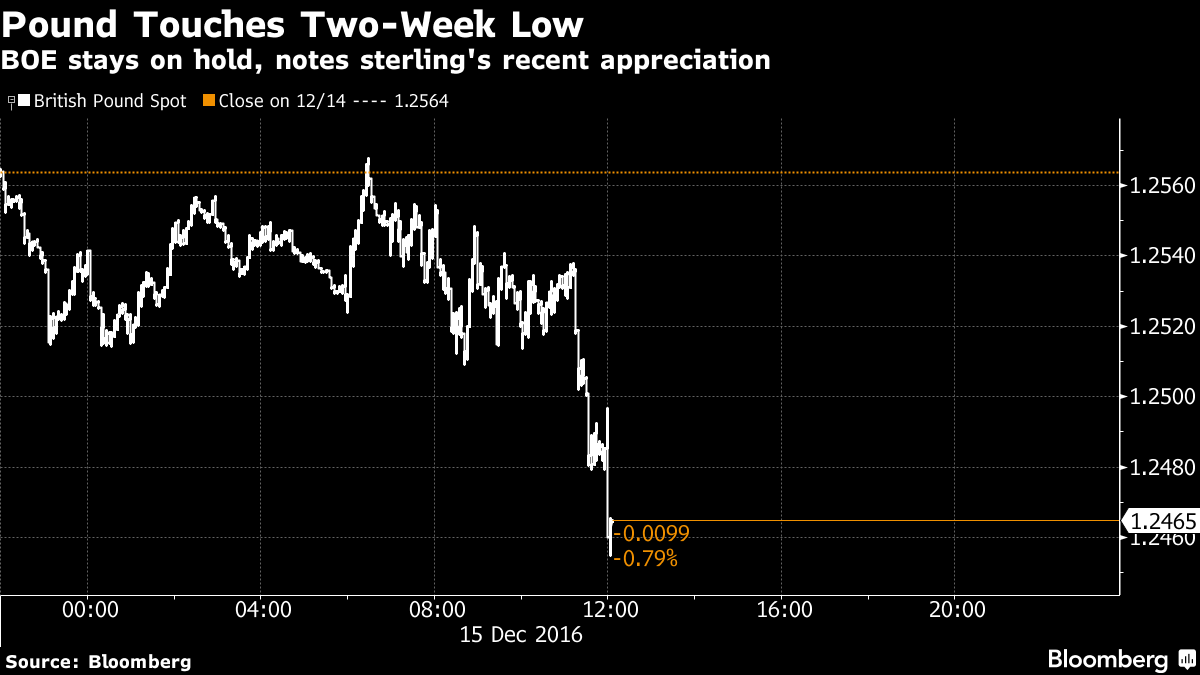

The pound dropped to a two-week low after the Bank of England voted 9-0 to keep monetary policy unchanged.Sterling weakened versus most of its 16 major peers. The U.K. currency climbed 2.2 percent against the dollar in November, posting its first monthly gain since April. Still, the pound has slumped 16 percent since Britain voted in June to leave the European Union, making it the Group-of-10’s worst-performing currency this year. In its last policy decision of 2016, the Monetary Policy Committee said sterling’s recent recovery could mean “less of an overshoot” above its 2 percent inflation goal than previously predicted.

U.K. government bonds slumped after the Federal Reserve raised U.S. interest rates Wednesday and signaled a faster pace of hikes in 2017 than previously anticipated. BOE officials maintained the asset-purchase target at 435 billion pounds ($542 billion.)

“The most important driver for sterling remains politics,” Kathrin Goretzki, a foreign-exchange strategist at UniCredit SpA in London, wrote in a research note before the announcement. “Markets seem to perceive a reduced probability of a hard Brexit. With markets having become more optimistic recently, we see the balance of risks for pound as tilted to the downside."

BOE Governor Mark Carney has said that policy makers will look through above-goal price gains to support growth and the labor market as the U.K. economy adjusts to the nation’s decision to quit the EU. The BOE last month said that inflation will go above its 2 percent target next year and stay there until the end of the decade. Data released Tuesday showed annual consumer-price inflation accelerated to 1.2 percent in November, the fastest pace since October 2014.

Market Reaction:

- The pound falls 0.8 percent to $1.2466 as of 12:10 p.m. in London, having touched $1.2455, the lowest since Nov. 30.

- Sterling gains 0.3 percent to 83.60 pence per euro.

- Benchmark 10-year gilt yields climb 12 basis points to 1.51 percent, after reaching 1.54 percent, the highest since May 5.

- The BOE’s decision to keep the key interest rate at a record-low 0.25 percent was forecast by all 62 economists in a Bloomberg survey.

- Source:Bloomberg

No comments:

Post a Comment