Even the best day since 2011 wasn’t enough to reverse fortunes for European stocks, which resumed declines on Wednesday.

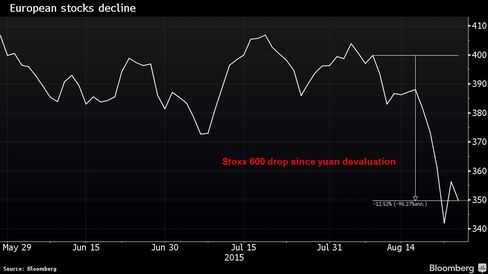

Investors have dealt with zigzags this week, as European stocks first slid the most since the financial crisis, before rallying yesterday after China cut interest rates. A global selloff triggered by China’s currency devaluation on Aug. 11 accelerated early this week, deepening a correction for the Stoxx Europe 600 Index and sending Germany’s DAX Index into a bear market.

“Fears over a global slowdown intensified but it’s overdone currently,” said Christian Stocker, a strategist at UniCredit Bank AG in Munich. “European markets lost 12 percent over four days. This isn’t based on facts but only on sentiment. We do not have signs for a recession or a new financial crisis. We see extremely oversold equity markets as a chance for medium-term investors to step in again.”

The Stoxx 600 fell 1.5 percent to 351.1 at 9:34 a.m. in London, after earlier sliding as much as 2.7 percent. The gauge has tumbled 11 percent this month, on course for the worst August since 1998. Seventeen out of 18 western-European markets fell 10 percent or more from their highs through Monday’s close.

German shares, among the most hurt by China-fueled volatility, dropped 1.2 percent today. All 19 industry groups declined, with health-care and energy shares leading losses. Novartis AG and Roche Holding AG, among stocks with the heaviest weighting on the Stoxx 600, slipped 1.9 percent or more.

Transocean Ltd. plunged 9.6 percent after the Swiss offshore rig operator said it plans to halt investor payouts and book 2 billion Swiss francs ($2.1 billion) in asset impairments after an oil price crash.

Volkswagen AG lost 2.3 percent after the carmaker said sales in China, its biggest market, declined about 5 percent in the first seven months of the year.

Paddy Power Plc and Betfair Group Plc rallied more than 17 percent after the betting companies, among Europe’s biggest, agreed to merge.

Abengoa SA jumped 14 percent, taking its four-day advance to 53 percent. The Spanish renewable energy company surged yesterday after a report its planned capital increase will include Class A shares, which have more voting rights.

source: Bloomberg

No comments:

Post a Comment