It's been a wild ride for Chinese stocks, with the MSCI China Index rising nearly 30 percent between January and April before falling off a cliff in June. That volatility has plenty of U.S. investors asking what impact China's roller coaster markets could have on companies in the S&P 500.

Goldman Sachs analysts led by David Kostin are here to attempt an answer.

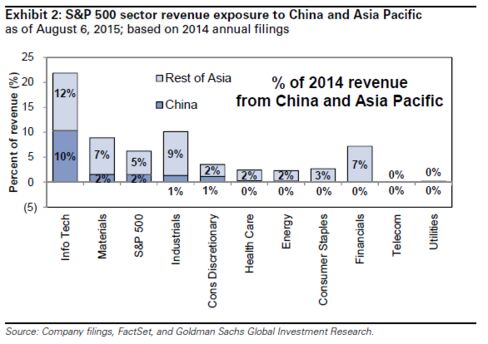

In new research, Kostin and co. take a look at the China exposure of S&P 500 companies. Overall, the analysts say, some $168 billion of S&P 500 revenue comes explicitly from China, according to company disclosures. That's a relatively low amount, equivalent to just 2 percent of total sales in the overall index, but the topline figure masks some large variations between sectors and firms.

The below chart shows the revenue exposure to China for each sector in the S&P 500. Information technology and materials are high on the list, with 10 percent and 2 percent exposure, respectively. Utilities and telecommunications are the lowest, each with zero percent exposure.

This table, meanwhile, lists the 20 stocks with the most sales exposure to China.

Big names on the list include Qualcomm, Intel, YUM! Brands, andWynn Resorts.

It's worth noting here that analysts have already been cutting their earnings targets for China-focused firms. Companies with high sales exposure to China have seen their earnings per share estimates slashed by 15 percent year-to-date compared to just an 8 percent cut for the S&P 500 overall, Goldman says. The analysts also note that China-focused companies in the U.S. have trailed the broader market since the MSCI Index peaked, falling 8 percent versus 1 percent for the overall S&P 500 index.

It's worth noting here that analysts have already been cutting their earnings targets for China-focused firms. Companies with high sales exposure to China have seen their earnings per share estimates slashed by 15 percent year-to-date compared to just an 8 percent cut for the S&P 500 overall, Goldman says. The analysts also note that China-focused companies in the U.S. have trailed the broader market since the MSCI Index peaked, falling 8 percent versus 1 percent for the overall S&P 500 index.

source: Bloomberg

No comments:

Post a Comment