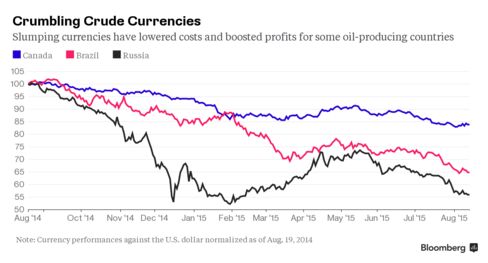

Crude bulls, stung by the worst July on record, should expect further pain as slumping commodity currencies cut production costs.

Drillers from Russia to Canada, the world’s second- and fourth-biggest oil producers, sell crude in U.S. dollars while paying most operating costs in local currencies. The Canadian dollar dropped to an 11-year low against its U.S. counterpart this month while the Russian ruble trades near a six-month low.

Global oil supply has proven resilient. A 60 percent decline in U.S. dollar prices since June 2014 hasn’t curbed U.S. production, which is near the highest level in four decades. Iraq is producing at a record pace and Russian oil output reached a post-Soviet high this year. The world’s oil glut will last through 2016, the International Energy Agency said in an Aug. 12 report.

“The cross-commodity downdraft led by oil, gold and copper has hit producer currencies hard,” Mike Wittner, head of oil-market research at Societe Generale SA in New York, said by phone. “The weaker their currencies get versus the dollar, the lower their costs. This further weighs on commodity prices and just adds to the negative spiral.”

Commodity currencies have been the worst performers in a Bloomberg ranking of major world currencies this year as raw-material prices collapsed and the Federal Reserve moved toward its first rate increase in almost a decade. The Brazilian real, New Zealand dollar and the Canadian loonie have led declines against the U.S. dollar.

Bear Markets

The Bloomberg Commodity Index of 22 raw materials has fallen 29 percent since last August, meeting the common definition of a bear market, which is a 20 percent drop. The loonie, as the Canadian dollar is known, also has taken a hit from declines in iron, aluminum and gold. Russia is the world’s biggest exporter of natural gas and a major producer of gold and coal.

“Divergence in currencies suggests a stronger dollar, weaker commodity currencies and hence lower production costs,” Jeff Currie, New York-based head of commodities research for Goldman Sachs Group Inc., said by phone.

West Texas Intermediate lost 8 cents to $41.79 a barrel on the New York Mercantile Exchange at 8:21 a.m. on Tuesday, after settling at the lowest since March 2009 on Monday. Brent crude dropped 16 cents to $48.58 on the London-based ICE Futures Europe exchange.

Double Dip

Oil prices are experiencing a “double dip” and could extend losses for a further 18 months, according to a Bank of America Corp. report dated July 24. Wittner of Societe Generale cut his third-quarter WTI forecast by $12.20 to $47.80 a barrel, and 2016 by $5 to $55 in an Aug. 6 report. He reduced third-quarter Brent by $11.90 to $53.10 and 2016 by $5 to $60.

A one-cent decrease in the Canadian dollar bolsters cash flow for Canadian Natural Resources Ltd., the nation’s largest heavy-oil producer, by C$55 million ($42 million) to C$60 million, Chief Financial Officer Corey Bieber said Aug. 6 on an earnings call.

Per-barrel production costs for Canadian oil producers have fallen about 20 percent from a year ago, helped by the exchange rate, and some of the savings will last, said Kyle Preston, an analyst at National Bank Financial in Calgary.

“It’s setting the industry to be a lot leaner going into a potential recovery,” Preston said. Canadian crude production is poised to rise 4 percent this year, according to the Canadian Association of Petroleum Producers.

Lower Ruble

The risks to Russia’s economy triggered by the slide in oil prices will be mitigated by the decline in the ruble, Vladimir Osakovskiy, the chief Russia economist at Bank of America in Moscow, said in July.

OAO Rosneft, the world’s largest traded oil producer, increased drilling by 27 percent in the first seven months of the year, the company said Aug. 13. The nation’s exports remain just as profitable as they were a year ago when the oil price was about $100, according to Citigroup Inc.

A U.S. rate gain, possible as early as September, would bolster the dollar and reduce the appeal of commodities priced in the American currency as a store of value. Futures show a 48 percent chance the Fed will raise borrowing costs at its next meeting on Sept. 16-17.

“When the Fed raises rates, it’s inevitable that the dollar will rise and oil will fall,” Michael Corcelli, chief investment officer of hedge fund Alexander Alternative Capital LLC in Miami, said by phone. “It’s not only the dollar that’s weighing oil, it’s also excess supply.”

source: Bloomberg

No comments:

Post a Comment