Australia’s dollar slid to a six-year low while the yen headed for its biggest weekly advance this year as investors sought safety before a U.S. jobs report that could encourage the Federal Reserve to raise interest rates for the first time since 2006.

The Aussie dropped against all its developed peers Friday, on track for the worst week since January against the greenback, amid concern Chinese shares will resume their slide when the stock market reopens following holidays this week. The yen headed for a third weekly gain after a China-led global stock routwiped about $7 trillion dollars from markets.

“There’s nervousness in the market about growth in Asia and the implications of the Fed changing policy, should payrolls be seen as clearing the way for a hike,” said Sean Callow, a strategist at Westpac Banking Corp. in Sydney. “The mood is probably gloomy enough that the Aussie is going to struggle near term.”

The Australian dollar fell 0.7 percent to 69.71 U.S. cents at 7:01 a.m. in London, after slumping as low as 69.59 cents, the weakest since April 2009. It has dropped 2.8 percent since Aug. 28.

The yen gained 0.6 percent to 119.32 per dollar, heading for a 2 percent weekly advance. That would be the steepest climb since the period ended Dec. 12.

Asian shares headed for a seventh straight weekly slump, with the MSCI Asia Pacific Index set for its longest weekly losing streak since 2011. Mainland Chinese markets will open Monday after signs of government intervention to prop up share prices before the nation’s World War II victory parade this week.

Fed Bets

Investors have pared bets on a September liftoff by the Fed to 30 percent amid turmoil in global markets, from 50 percent a month ago. The calculation is based on the assumption that the effective fed funds rate will average 0.375 percent after the first increase.

The nonfarm payrolls report represents the last major data point before the Fed meets on Sept. 16-17. U.S. markets are closed on Monday for Labor Day.

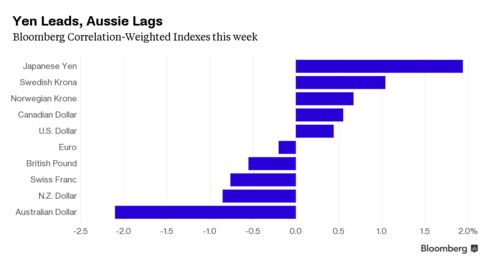

The Bloomberg Dollar Spot Index, which tracks the currency versus 10 major peers, was little changed Friday at 1,211.50. It has climbed 0.3 percent since Aug. 28, headed for a second weekly gain.

“If they do hike in September, we will see more market volatility and more uncertainty as a result of that,” Mitul Kotecha, head of Asia Pacific currency strategy at Barclays Plc in Singapore, said in a television interview. “In that sense the Fed may just back off from moving.”

source: Bloomberg

No comments:

Post a Comment