What happens in Beijing doesn’t stay in Beijing.

The high costs associated with maintaining the yuan’s peg to the U.S. dollar amid weakening economic data prompted a startling currency devaluation by China on Aug 11. Since then, the move has come to be viewed as the proximate cause for the upheaval in financial markets over the past month, and led to devaluations from other nations with fixed exchange rates.

Capital outflows have been Chinese policymakers’ biggest headache. These waves of money leaving the world’s second-largest economy are a source of downward pressure on the yuan and have a deleterious effect on domestic liquidity – the last thing a nation that’s enjoyed an extended run of buoyant, credit-fueled growth needs.

Because China’s delicate balancing act isn’t a permanent solution, market participants are wondering how – and when – it might end.

Analysts at Deutsche Bank, Barclays and Societe Generale estimated last week that the People’s Bank of China depleted its foreign reserves by between $100 to $200 billion in August in order to stabilize the yuan after the shock devaluation prompted traders to see how low the exchange rate could be pushed and capital outflows, in all likelihood, did not abate. As such, the recently stability in the exchange rate has been a façade – and an expensive one at that.

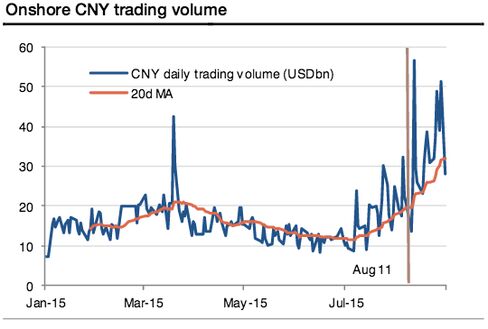

“The PBoC appeared to be heavily active in the spot market after the currency regime change on 11 August in order to stabilize the yuan,” wrote Societe Generale China economist Wei Yao.“Onshore yuan trading volume almost doubled in the 15 trading days following 11 August, compared to the previous 20 trading sessions and the year to date average.”

Societe Generale

Meanwhile, Barclays’ rates and foreign exchange team estimates that the People’s Bank of China would have to cut the reserve requirement ratio by a minimum of 40 basis points per month just to offset negative effects on liquidity from its foreign exchange interventions, given the current pace of capital outflows.

This fragile equilibrium, however, could endure for longer than you might expect.

Even after the drawdown in August, Societe Generale’s Yao estimates that the People’s Bank of China has a hefty $3.5 trillion in foreign reserves. According to official data released on Monday, China's currency hoard declined by a less-than-feared but still significant $93.9 billion in August, leaving it with $3.56 trillion remaining.

Chinese policymakers likely desire to maintain a sizable buffer in the form of foreign reserves, so Yao thinks they would only be willing to sell $1 trillion of their assets in order to defend the yuan. This suggests that China could probably maintain its current exchange-rate management tactics for many months, but not necessarily years.

Chinese policymakers can try to stabilize their exchange rate through actions other than direct intervention. Societe Generale’s Yao has suggested that the imposition of more capital controls could prevent more funds from leaving the country. On the other hand, Deutsche Bank Chief China Economist Zhiwei Zhang points out that the government could open up financial markets to more participants, like insurance companies, in order to induce flows into the country.

Mercifully for China, the storm appears to be abating, for now.

“On the first two trading days in September, the [dollar-yuan] rate actually had sizable appreciations with shrinking daily trading volumes,” observed Zhang.

Deutsche Bank

But going forward, it’s only a matter of when and how much the yuan will fall, according to the analysts.

Barclays and Societe Generale are calling for the yuan to decline by 7 percent relative to the U.S. dollar by year-end, with Yao citing the futility of this “war of attrition against capital outflows."

“[T]he longer that significant FX intervention takes place, such costs [in terms of foreign reserve depletion, tightening domestic liquidity, and the need to offset it] will increase, and likely only delaying, rather than reducing, expectations of further CNY depreciation,” added Barclays.

Deutsche Bank expects a much more modest depreciation for the duration of 2015. For now, Chinese policymakers will be content to watch how financial markets digest an interest rate hike from the Federal Reserve before making their next move, according to Zhang.

“We expect the government to keep the current arrangement for the rest of 2015, and monitor how international market reacts to rate hike in the U.S.,” he asserted. “It is unlikely that the People’s Bank of China attempts to repeat what it did on Aug. 11 before the U.S. rate hike.”

source: Bloomberg

No comments:

Post a Comment