China’s sway over global financial markets continued, as a late rally in Shanghai stocks helped buoy investor sentiment around the world, sending shares higher with oil and metals.

U.S. stocks rebounded as trading resumed following a holiday weekend, emerging markets jumped and European stocks gained for a second day. Brent crude rose for the first time in three days and copper led gains in industrial metals. Currencies of commodity-producing nations strengthened and Treasuries declined.

Investors looked past trade data showing China’s exports fell last month as Shanghai stocks climbed in a pattern that on recent occasions has been consistent with state intervention to prop up the nation’s equities. U.S. markets reopened on Tuesday with traders confident the Federal Reserve will raise interest rates by year-end.

“It seems that there is less stress about the Chinese market,” said John Plassard, senior equity sales trader at Mirabaud Securities in Geneva. “This weekend the Chinese government said the worst is behind us. If you add that to the measures to intervene, it’s quite reassuring.”

Stocks

The Standard & Poor’s 500 Index added 1.6 percent at 1:12 p.m in New York, reversing a slump on Friday and bringing a modicum of calm to a market characterized by volatility before the Fed’s meeting next week.

The S&P 500 has swung up or down an average of 2 percent a day for more than two weeks through Friday, while before Aug. 20, the 2015 average was around 0.6 percent. The Chicago Board Options Volatility Index slid 8.3 percent to 25.73.

Investors see a 30 percent chance of a Fed liftoff next week, compared with 58.7 percent odds of an increase by year-end. The calculation is based on the assumption that the effective fed funds rate will average 0.375 percent after the first increase.

“Now that China showed that it was not going to break down further, our market is taking back what it lost on Friday,” said Matt Maley, an equity strategist at Miller Tabak & Co LLC in New York. “The market got hit hard on Friday because people were worried about China.”

The Stoxx Europe 600 Index climbed 1.2 percent, with automakers and commodity producers leading gains among 19 industry groups. Stocks rose on Monday amid relief the resumption in Chinese trading didn’t spark a deeper selloff.

(For more stocks news, click: TOP STK.)

Emerging Markets

The MSCI Emerging Markets Index added 1.7 percent, its first gain in three days. Brazil’s real, the South African rand and Russian ruble strengthened at least 1.2 percent as a gauge of 20 developing-nation currencies rose, ending a five-day run of losses.

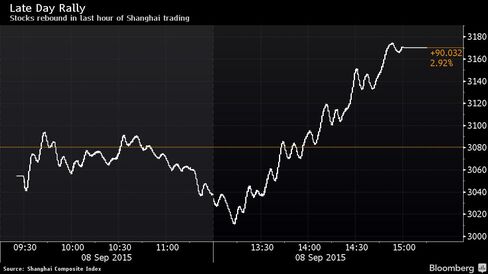

China spurred the rally as the Shanghai Composite swung from a loss of 2.3 percent to a gain of 2.9 percent. The number of shares changing hands was 40 percent below the 30-day average. Stocks fell 2.5 percent on Monday as trading resumed following a two-day holiday.

“Trading is very volatile as the volume is extremely thin,” said Castor Pang, head of research at Core-Pacific Yamaichi Hong Kong. “State funds may be focusing the purchase on some large companies including financials and helping with a rebound in the broader market.”

Hong Kong’s Hang Seng China Enterprises Index jumped 4.1 percent, its second advance since Aug. 13, and benchmark gauges in Russia, India and South Africa gained more than 1 percent.

China overseas shipments fell 5.5 percent in August from a year earlier in dollar terms, less than the median forecast of a 6.6 percent decline by economists surveyed by Bloomberg. That also compared with an 8.3 percent drop in July, before the devaluation of yuan on Aug. 11, which sparked a rout in emerging markets and triggered more than $8 trillion of global equity losses.

(For more news on emerging markets, click: TOP EM.)

Commodities

Industrial metals rallied on speculation that a turnaround in China will stimulate demand. All the contracts posted gains on the London Metal Exchange, with copper up 2.3 percent. Gold held near the lowest in three weeks.

Brent crude rebounded, climbing as much as 3.3 percent to $49.20 a barrel in London.

“Trade is feeding off the gains we’ve seen in the Chinese stock market,” Robin Bhar, an analyst at Societe Generale SA said by phone from London. “China is immensely important in terms of commodity demand and in terms of global sentiment, so any sign of a turnaround there will be positive for markets around the world.”

(Bloomberg Seminar on Commodities BBTV 238835900. For more news on commodities, click: TOP CMD.)

Currencies

Australia’s dollar led gains among major currencies, jumping 1 percent to 69.95 U.S. cents, its biggest advance since Aug. 12. The Aussie was boosted by a report on Tuesday that showed a gauge of business conditions improved last month, even as confidence worsened.

The yen dropped 0.5 percent to 119.83 per dollar and the euro was little changed at $1.1183.

JPMorgan Chase & Co.’s global foreign-exchange volatility index reached 11.30 percent, matching the highest since February, and up from 8.78 percent in July.

(For more news on currencies, click: TOP FX.)

Bonds

Treasuries declined, pushing 10-year note yields seven basis points higher to 2.19 percent, amid reduced demand for haven assets and after data on Monday showed China’s foreign-exchange reserves fell by a record last month. The U.S. will also sell $24 billion of three-year notes on Tuesday, the first of three auctions of coupon-bearing debt this week.

Italian bonds rose, pushing the 10-year yield six basis points lower to 1.83 percent.

Automatic Data Processing Inc. and Home Depot Inc. were among companies that announced plans to tap the bond market Tuesday after a 13-day drought in new issuance. Bond sales by U.S. investment-grade companies are cranking back up after global growth concerns kept issuance at bay in the worst late-summer drought since 2005.

source: Bloomberg

No comments:

Post a Comment